Elevate modern apps with TiDB.

The client is a leading bank with over 200 branches worldwide dedicated to providing professional and comprehensive financial services. It is proudly ranked within the Top 150 banks by Tier 1 capital on The Banker (TB) 2024 global list.

With the rapid expansion of electronic channels, customers increasingly demand the convenience and superior experience of detailed transaction history queries. Catering to such personalized needs makes the historical bank statement query service emerge as a key business system server across various customer touch points.

The first generation of the historical statement query architecture involved replicating detailed data from the core Oracle accounting system to partitioned tables within another Oracle cluster. Core interfaces queried the historical statement cluster by date, utilizing existing resources to initiate operations swiftly and meet basic statement query needs.

However, as data volumes surged and business requirements evolved, performance bottlenecks in complex queries emerged, slowing responses under high concurrency. The lack of data preprocessing compromised flexibility and efficiency, creating difficulty in adapting to personalized business scenarios.

The second-generation architecture shifted to a big data technology stack to resolve these issues. Using offline ETL processes to sync data to a big data platform, Hive aggregated summary and detailed tables before importing data into Elasticsearch and HBase.

Elasticsearch served as a full-text search engine for rapid text information retrieval, while HBase, a NoSQL database, stored structured data. Combining Elasticsearch for querying and HBase for storing complete records by keys solved the rapid query challenge for massive data volumes.

Compared to the first-generation architecture, this second-gen system is decoupled from the core. It migrates and further processes core statement data, operating without the limitations of the core framework. It leveraged offline data processing to replace real-time summary calculations and joins in online environments.

Despite advancements, the second-generation architecture couldn’t handle transaction queries on the same day since it used offline data. Integrating core interfaces to accommodate real-time business requirements necessitated querying current-day data and merging it with T-1 data for real-time responses. Additionally, the big data cluster shared resources with other services, causing potential performance issues due to resource contention, highlighting the need for further optimization.

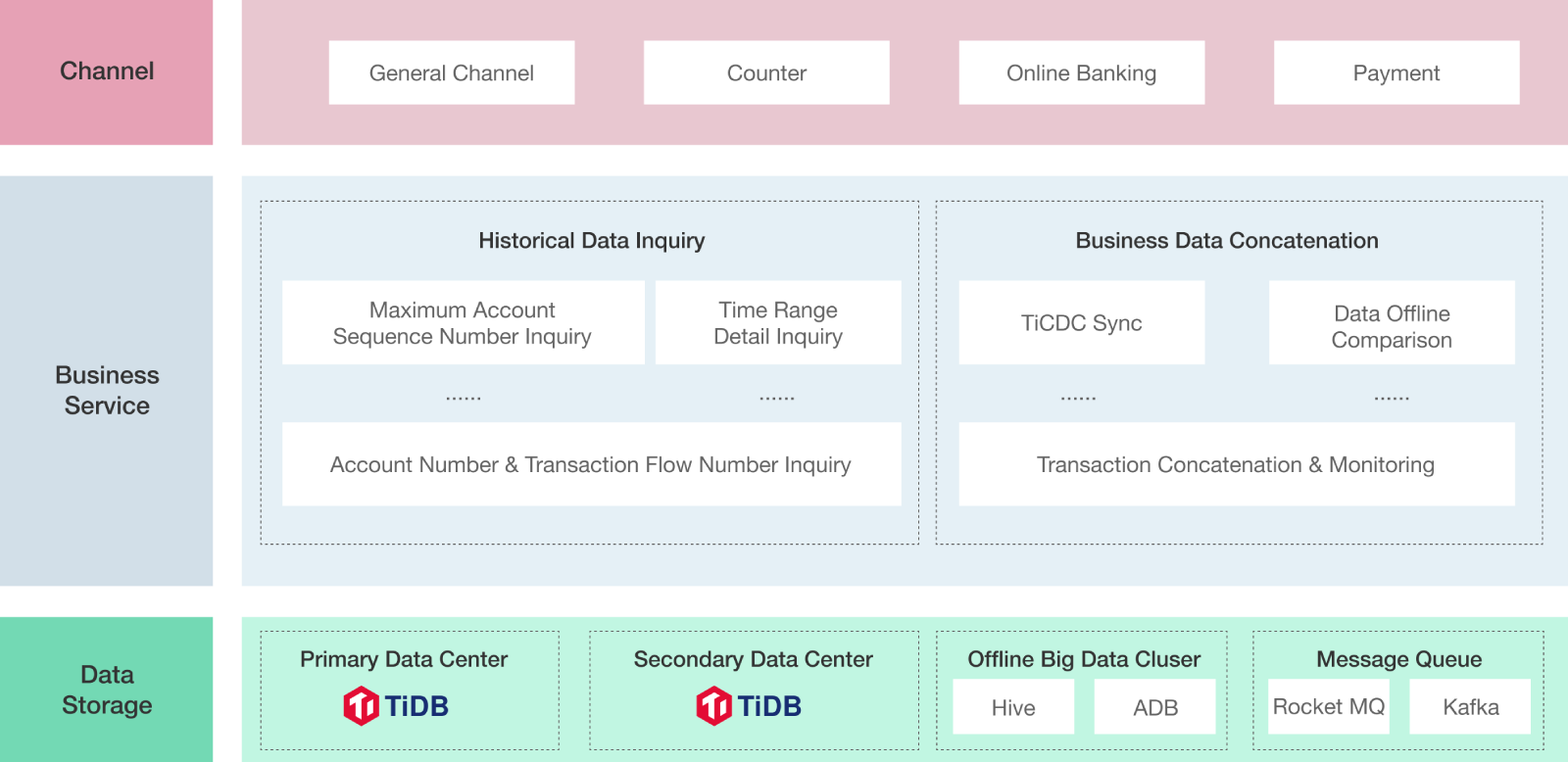

In the latter half of 2023, the bank implemented TiDB, an open-source distributed SQL database, to develop a cutting-edge architecture for querying historical bank statements. This new system relies on TiDB’s native distributed database technology. It features an active-active deployment strategy within the same city, utilizing two copies at each of the two central data hubs and four TiKV storage nodes.

This configuration ensures robust synchronization across data centers. The result is a solution offering financial-grade data consistency, zero data loss, high processing speed, and minimal latency, significantly bolstering system availability and scalability for future growth.

TiDB’s architecture supports complex, multi-condition queries that integrate various parameters, such as account numbers, transaction dates, transaction types (debit/credit), transaction codes, transaction amounts, and serial numbers. This flexibility significantly enriches the customer experience by allowing detailed, tailored transaction history queries.

Moreover, the system provides unified and standardized services for querying historical statement details across all customer interaction channels. This integration enhances the efficiency of business operations and streamlines data handling, making it easier to manage and retrieve historical financial information across the bank’s expansive network.

TiDB’s innovative distributed database architecture does more than just solve traditional performance and scalability challenges. It also significantly enhances the user experience by offering fast, flexible, and reliable data query capabilities. By integrating this advanced technology, the bank maintains its position at the forefront of financial services, adeptly meeting the dynamic needs of its customers and ensuring ongoing operational continuity.

Elevate modern apps with TiDB.