Elevate modern apps with TiDB.

The client is a leading bank with over 200 branches worldwide dedicated to providing professional and comprehensive financial services. It is proudly ranked within the Top 150 banks by Tier 1 capital on The Banker (TB) 2024 global list.

The core banking system is the bank’s IT infrastructure’s backbone, primarily handling deposit and loan operations. It underpins other business subsystems, and its performance and service capacity are pivotal for optimizing business processes, customer experience, and innovation.

The bank was facing exponential growth in data volume, frequent transaction updates, transaction hot spots, multi-channel concurrent transactions, and considerations for data security and system stability. The bank decided to build a new generation of core banking systems to address these challenges effectively. The bank’s database system requirements included four key aspects:

The bank conducted comprehensive tests on TiDB, an open-source distributed SQL database, across multiple dimensions—including software development, data migration, business transactions, operational monitoring, and disaster recovery. TiDB had significant advantages in usability, stability, multi-center active-active deployment, horizontal performance scalability, and HTAP (Hybrid Transactional/Analytical Processing) capabilities.

Adopting the “lean” core design philosophy, the bank restructured its new generation distributed core system by splitting the “fat” core. The infrastructure layer, leveraging container, cloud, and distributed database technologies, delivers scalable system operations and data service capabilities. During the development and design of the new core system, the bank migrated business logic to TiDB database without significant modifications to the business architecture.

The core banking system harnesses TiDB’s scalability advantages without invasive development processes for “unitization” or table sharding key design. It aligns with commercial banking business system design characteristics and meets business development planning goals for a favorable cost-benefit ratio.

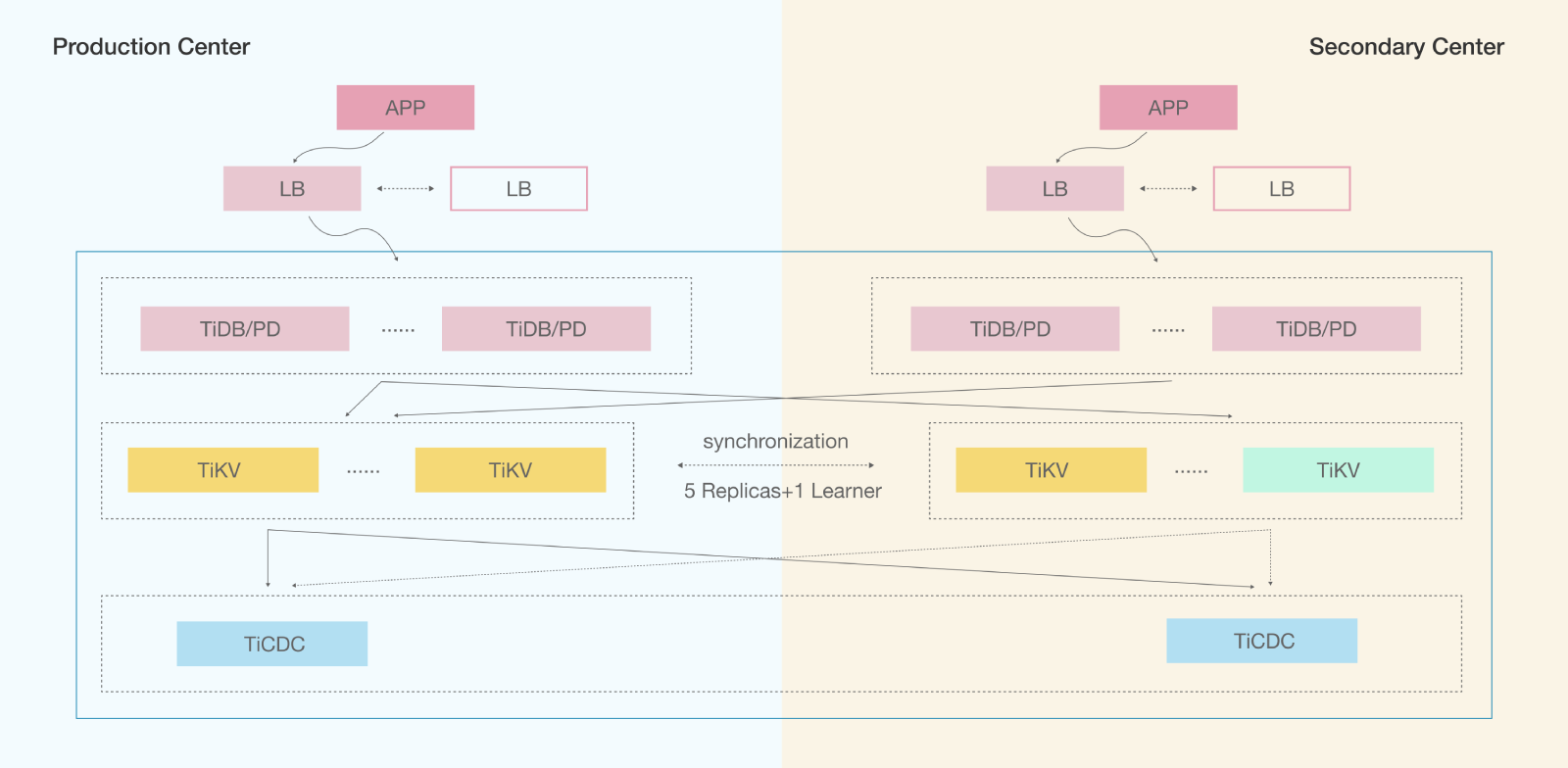

The TiDB cluster employs a dual-center active-active architecture with strong synchronization across 5+1 replicas—3 voter replicas in the primary center and 2 voter + 1 learner replicas in the secondary center. This setup reduces resource investment and operational complexity compared to the common three-center scheme. The architecture enables automatic failover, with the log mode downgrading to asynchronous during replication network anomalies or secondary center service issues, ensuring transaction continuity.

In November 2023, the bank’s new generation core banking system was successfully launched. The new core system, utilizing cloud-native and distributed database technologies, has operated efficiently and stably since its deployment, handling daily transaction volumes of 15 million and 55 million service calls. Customer experience has significantly improved, with the new core’s online transaction performance markedly enhanced—average response time is less than 100 milliseconds, a 54% reduction. Additionally, end-of-day batch processing efficiency has doubled, achieving 2.1 times that of the legacy system.

The new distributed core system fundamentally resolved the performance bottlenecks of the previous business system, providing robust technical support for rapid business growth. Its superior performance, stability, and scalability effectively support future market changes and business transformation over the next decade.

This bank’s success in selecting TiDB showcases the database’s suitability for handling the demanding requirements of core banking systems. With its general-purpose, non-hardware-bound architecture, TiDB offers a versatile and future-proof solution. Furthermore, its open-source nature and active community ensure the software evolves rapidly to meet new challenges–future-proofing business operations.

Elevate modern apps with TiDB.