Elevate modern apps with TiDB.

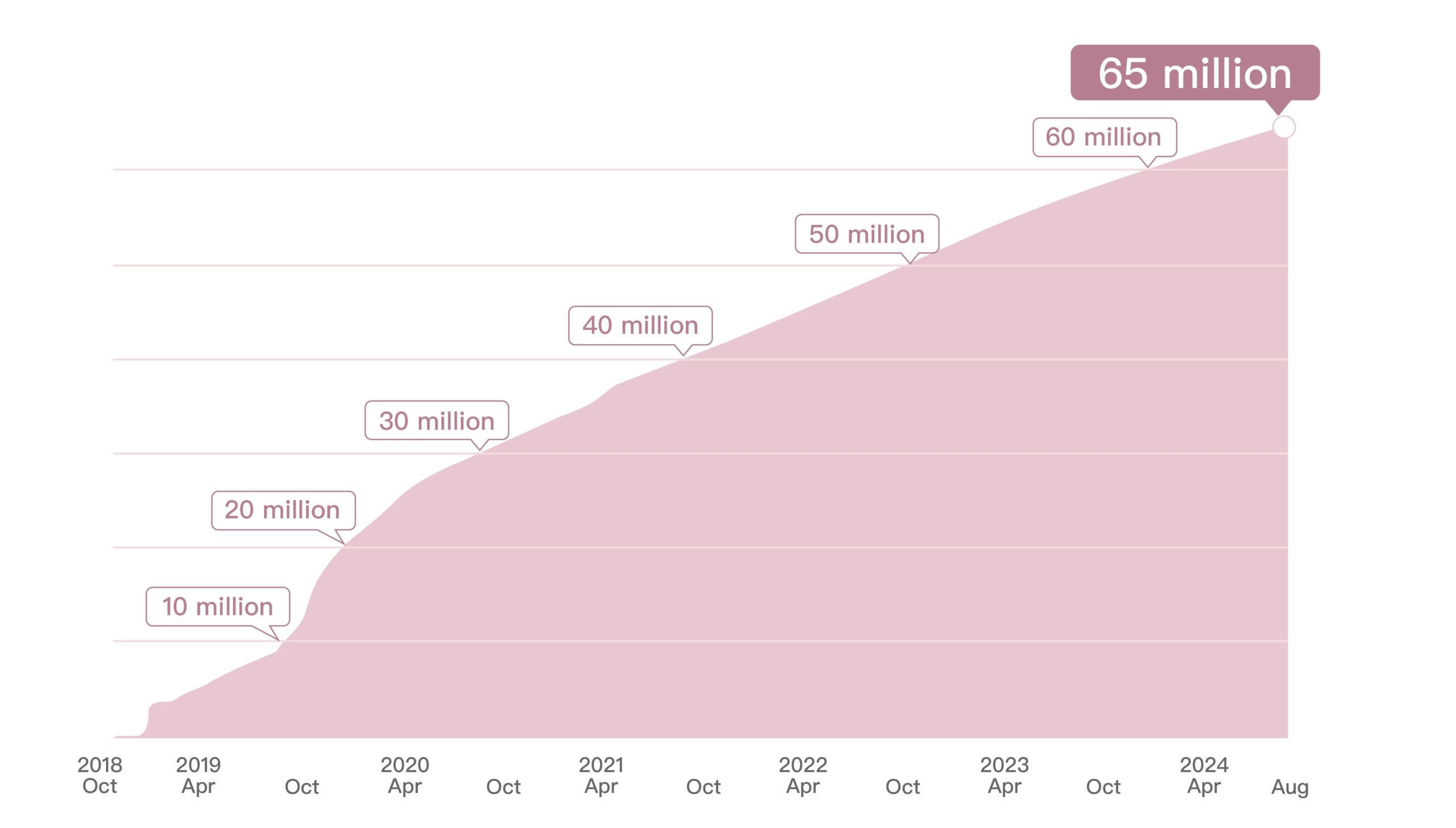

A leading Japanese FinTech company experienced rapid growth, fueled by a popular mobile payment application. The company faced significant challenges in managing its database infrastructure with a user base surpassing 65 million while processing over $67 billion in annual transactions. The core payment system, initially built on Amazon Aurora MySQL, struggled to keep pace with the escalating transaction volume and frequent traffic spikes.

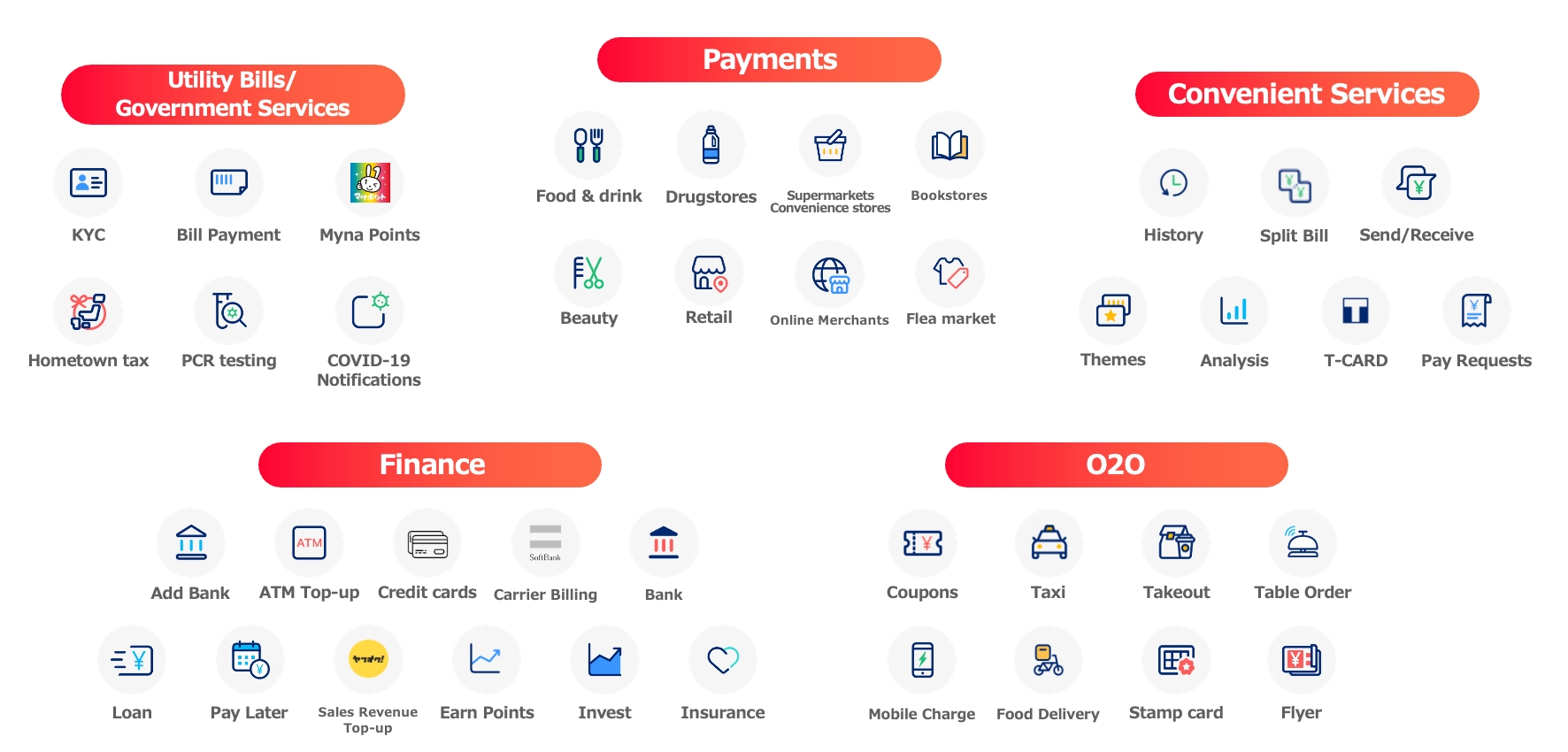

This FinTech company offers online and offline payment solutions and supports various payment methods. Users can scan a merchant’s QR code using its app or have their barcodes scanned at the POS. Additionally, online merchants use them for transactions. Users can pay through registered credit cards or wallet balances. Now, with payment as the core business, this company is aiming to become a comprehensive app that can be used in all aspects of daily lives.

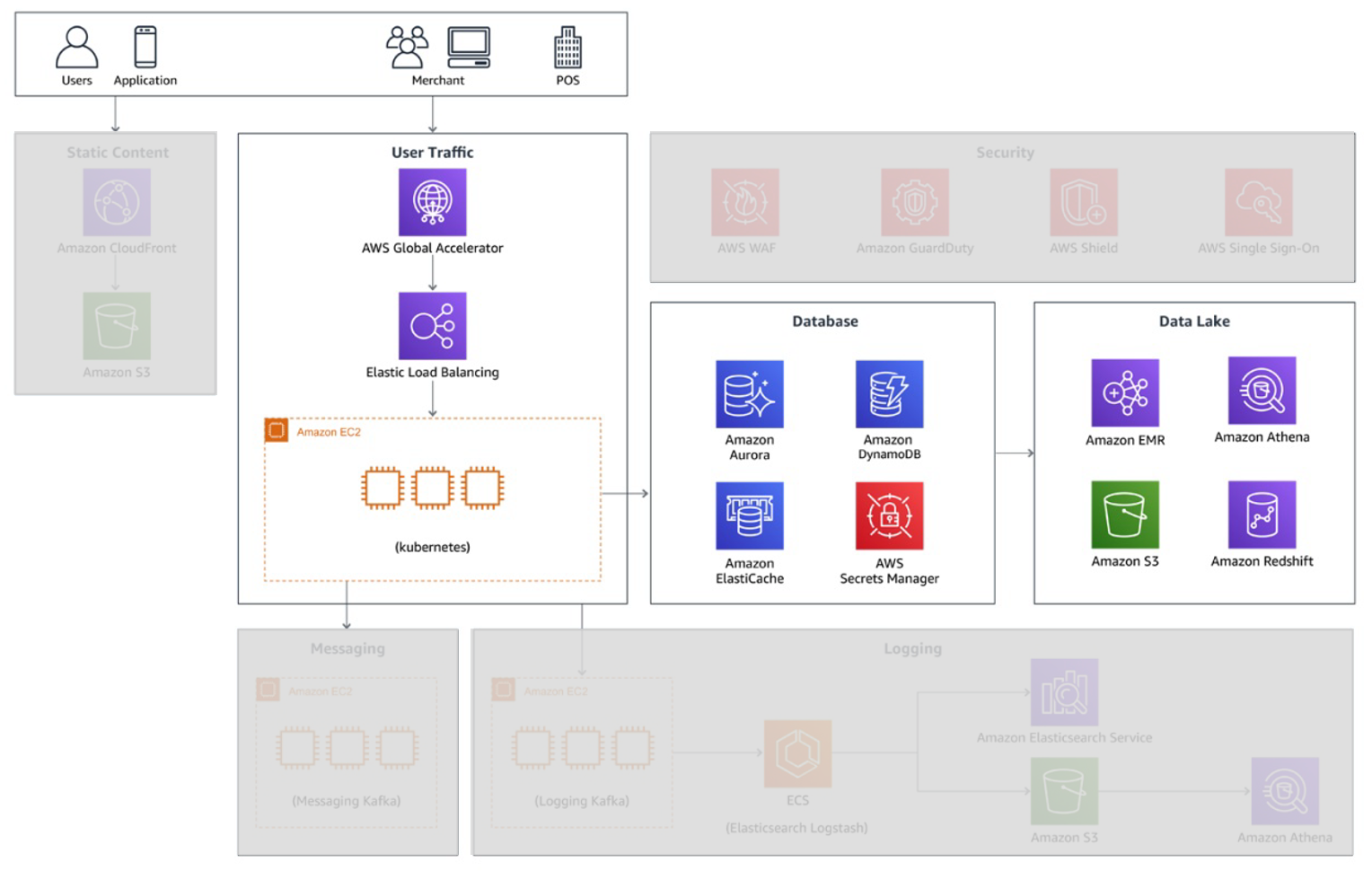

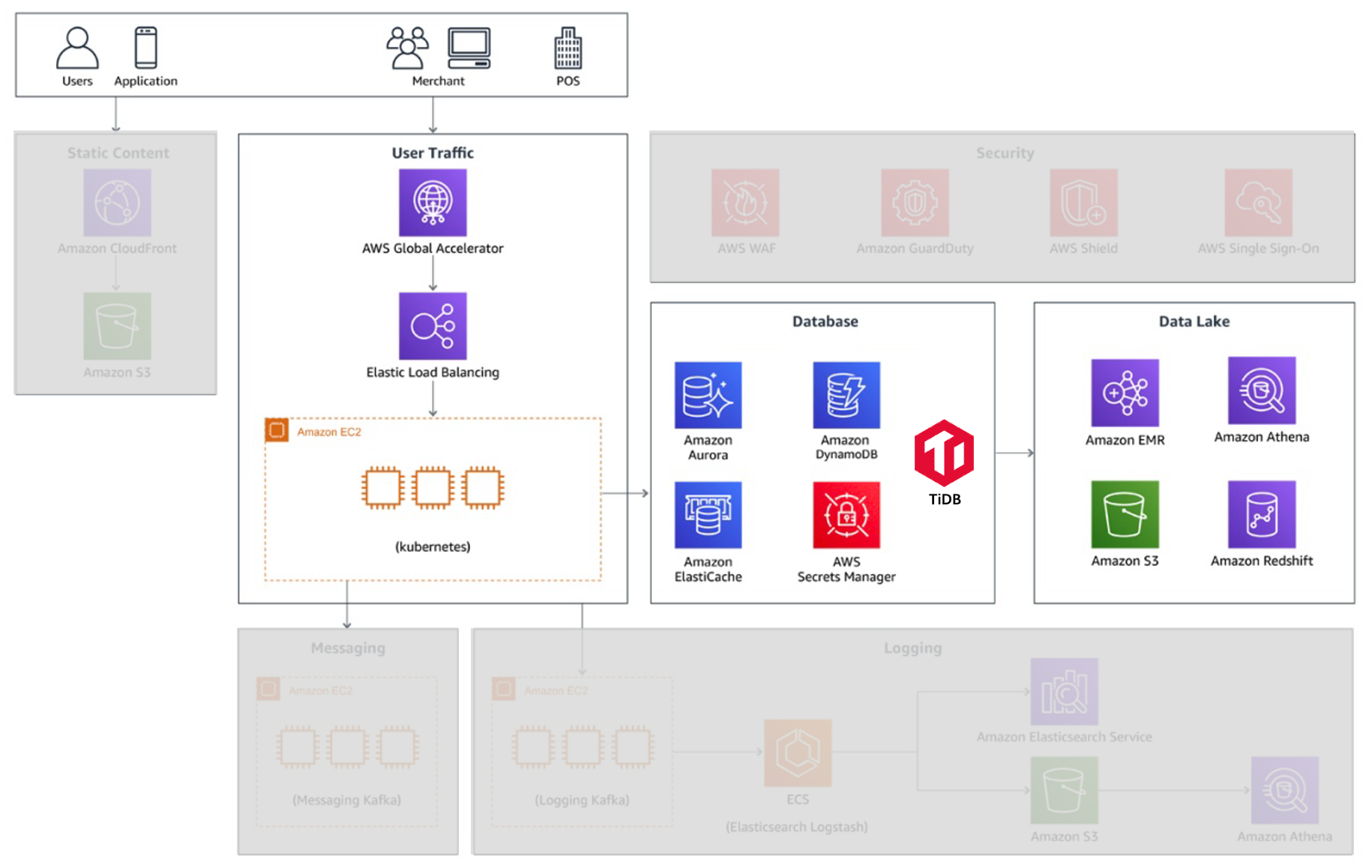

The company’s payment system was a complex ecosystem comprising 80+ microservices, primarily built on Java and Spring Boot. All payment and transaction data are handled by the primary database, Amazon Aurora MySQL. As the business grew, the payment database became a bottleneck, necessitating a move to a more scalable database.

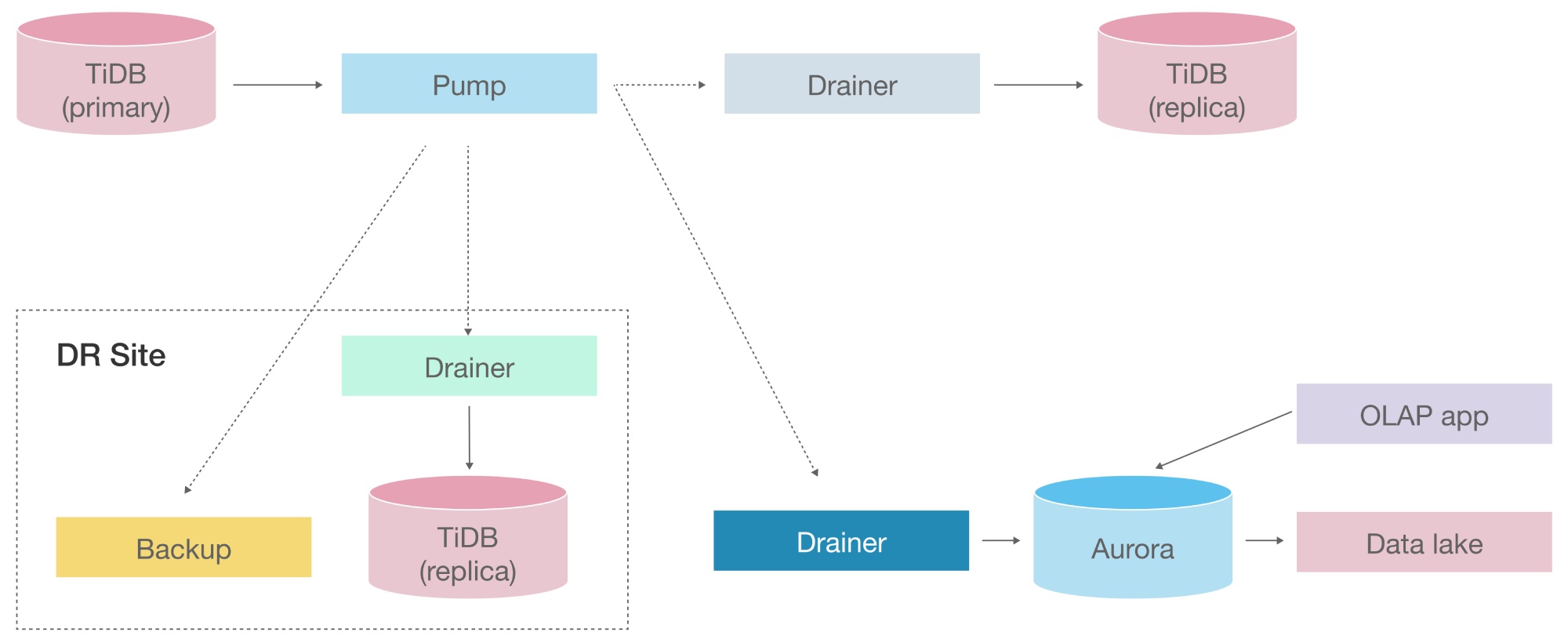

After migrating partially to TiDB, the company’s architecture underwent significant changes to address its previous challenges while still leveraging Amazon Aurora MySQL’s strengths.

The migration to TiDB enabled the company to optimize the performance and reliability of its most critical components while still leveraging Amazon Aurora MySQL’s strengths for other parts of its system. This hybrid approach allowed them to address specific challenges effectively and maintain a robust and scalable architecture.

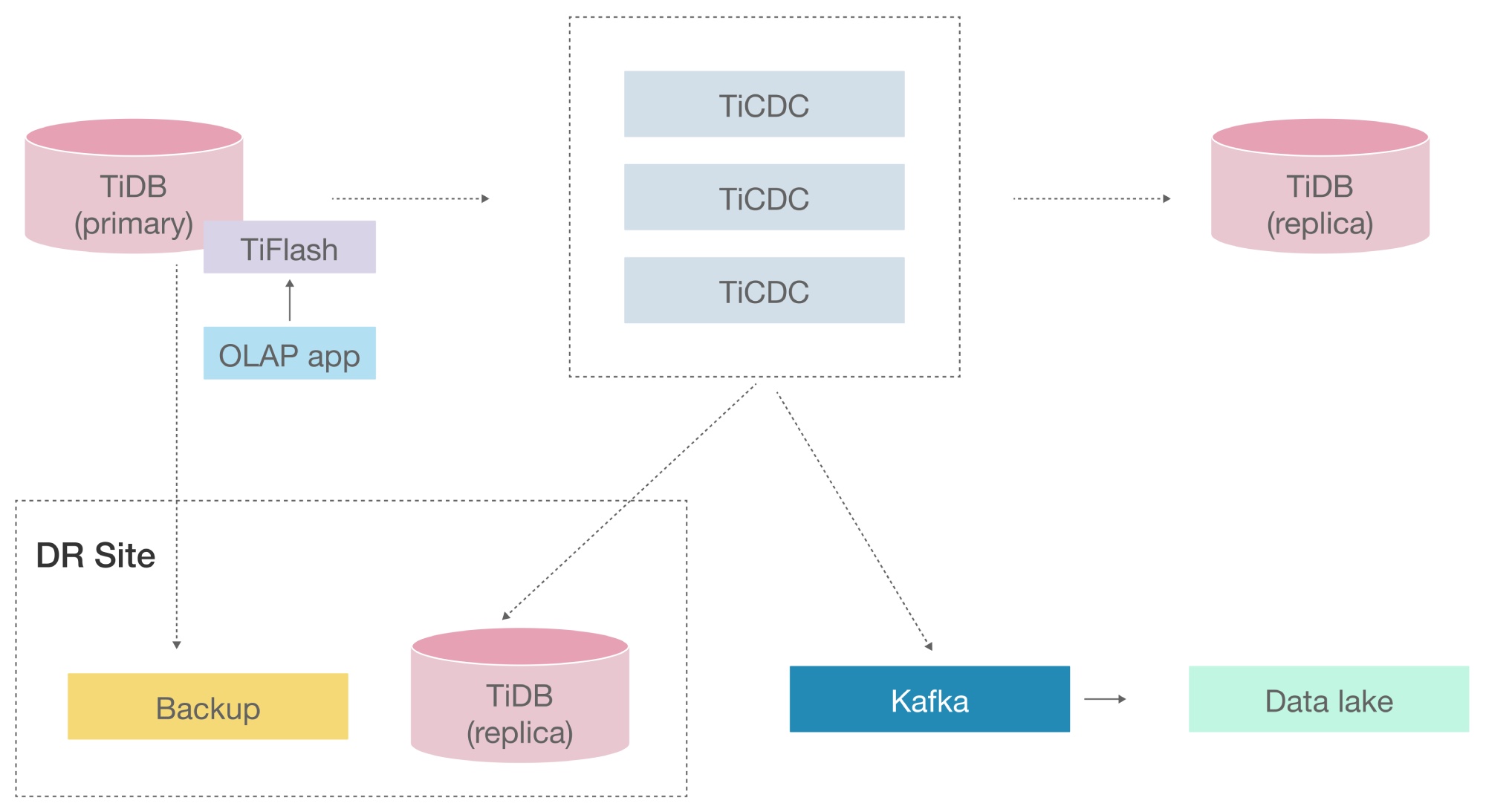

As the company continues to evolve, its architectural roadmap includes critical upgrades aimed at further optimizing scalability, performance, and analytical capabilities. One of the key components in this future architecture is the replacement of TiDB Binlog (composed of Pump and Drainer) with TiCDC. This transition is necessary to improve data replication and streaming capabilities, providing real-time data processing and ensuring minimal latency in the system’s transactional operations. TiCDC will enhance the overall data synchronization between the components, making the architecture more resilient and responsive to dynamic data flows.

In addition to this, the company also plans to introduce TiFlash to replace Amazon Aurora’s OLAP functionalities, which will simplify the overall system architecture and reduce operational overhead.

This forward-looking strategy will allow the company to maintain its leadership in the FinTech space, continuously delivering high-performance services that adapt to evolving market needs.

This Japanese FinTech company’s successful migration to TiDB has not only resolved its critical scalability and performance issues but also set a benchmark for similar businesses grappling with rapid growth and complex transactions. By choosing TiDB, it leveraged a horizontally scalable, MySQL-compatible database solution that minimized application changes and simplified management.

For businesses experiencing similar challenges—whether it’s due to exponential user growth, high transaction volumes, or the need for reliable disaster recovery—TiDB offers a compelling solution. Its ability to provide horizontal scalability and strong consistency without complex sharding makes it an attractive choice for companies in sectors like FinTech, E-Commerce, and beyond. TiDB’s architecture ensures your database infrastructure can seamlessly keep pace as your business scales, offering robust performance and reliability.

Elevate modern apps with TiDB.